Trans Union Cannot Stop Cento Law

Freezing Your Credit After Equifax's Data Breach

4 Million Hoosiers Have Been Affected by Equifax's Data Breach

Trans Union Fails to Stop Cento Law

Yesterday the Seventh Circuit Court of Appeals ruled in our favor and against Trans Union's efforts to block us from representing a consumer in a mixed file credit reporting case. Here is a link to the full opinion in Watkins v. Trans Union. In the coming days, we will be posting additional information about that opinion and the six year long saga which lead to this moment. For now, we are very pleased with the majority opinion.

How to Dispute Errors on Credit Reports

4 Simple Steps on How to Dispute Inaccuracies on Credit Reports

Disputing inaccuracies on a credit report can be a daunting task. Following these step-by-step instructions will aid you in correcting credit reporting errors in the most timely manner possible:

Step 1: Obtain your free credit reports

Obtaining your credit report is the first step in disputing any inaccurate or wrong information which may appear on it. Federal law requires the three national credit reporting agencies, Equifax, Experian, and Trans Union, to provide you with a free credit report every year. Most likely, each of these credit reporting agencies has a credit file on you. Get all three of your credit reports.

Credit Agencies To Ease Up On Medical Debt Reporting

NPR - Millions of Americans have medical debt that's hurting their credit. The Consumer Financial Protection Bureau estimated it's as many as 43 million people, according to data released in late 2014.

Now, some relief may be on the way.

Changes in the way credit agencies report and evaluate medical debt are in the works. They should reduce some of the painful financial consequences of having a health care problem.

Starting Sept. 15, the three major credit reporting agencies — Experian, Equifax and TransUnion — will set a 180-day waiting period before including medical debt on a consumer's credit report. The six-month period is intended to ensure there's enough time to resolve disputes with insurers and delays in payment.

76 Percent of Consumers Report Incorrect Info on Credit Reports

The most common issues identified by consumers are problems with incorrect information on their credit reports.

The Consumer Financial Protection Bureau (CFPB) reports that 76 percent of consumers who filed complaints about credit reporting stated that they had incorrect information on their credit reports. The CFPB has handled approximately 185,700 credit reporting complaints since July 21, 2011, making credit reporting the third most-complained-about product. This is important to you because it means that there is a very good change your credit reports have inaccurate information on them. Inaccurate information can lead to increased interest rates, prevent you from getting a mortgage or buying a car, landing a job, or getting a security clearance.

Are you sure your credit report contains only your information?

Equifax is being sued for mixing the credit file of one man with the credit file of the man's father.

Equifax is being sued for violated in Fair Credit Reporting Act

Earlier this year, Cento Law filed a complaint against Equifax for mixing the credit report of the plaintiff with information belonging to the plaintiff's father.

The plaintiff was first alerted to the mixed credit file when he was eighteen years old. At the time he was living at his parents and working. The alert came when he received a letter that was attached to his paycheck. The letter was from a county auditors office and its purpose was to inform the plaintiff that his wages were going to be garnished due to unpaid property taxes. Eventually the plaintiff learned that the property taxes in question were actually taxes levied against a man that he shared the same name with, his father.

As time went by, plaintiff was able to obtain a loan for a vehicle. He paid his loan on time with the hope of creating good credit. Two years later...

Update: Credit Industry Reform

An update on the National Consumer Assistance Plan

On March 8, 2015, Equifax, Experian and TransUnion (CRAs) entered into a settlement agreement with the NY Attorney General along with 31 additional AGs from other states. Upon entering the agreement, the CRAs announced that they would address a number of credit reporting industry problems, including their dispute process and how they handle unpaid medical debt. This agreement is referred to as the National Consumer Assistance Plan.

The credit reporting industry overhaul is taking place nationally over the course of three plus years with 2018 as the deadline to have all changes made. The overhaul will be implemented in three phases (detailed below) to allow the CRAs to update their IT systems and procedures with data furnishers.

To date, changes to websites and other technical tasks have been acomplished. A change to be implemented this September will address the dispute process. The CRAs will be using trained and empowered employees to review the documentation accompanying disputes. And, if a furnisher says its information is correct, the credit reporting agencies must still look into it and resolve the dispute.

In addition, the credit reporting overhaul will require CRAs to wait 180 days before adding any medical debt

What to do if Your Credit Dispute is Denied

Your legal rights under the Fair Credit Reporting Act

According to the FCRA, the credit reporting agencies, Equifax, Experian & Trans Union (also referred to as CRAs) must investigate your dispute. Upon receipt of your dispute, the CRAs have 30 days to complete their investigation and provide you with their findings. The law requires their findings to be accompanied by a free credit report. If their investigation led to the denial of your credit dispute, now is the time to seek legal counsel to enforce your legal rights.

Prior to obtaining legal representation, ensure you have followed the dispute process accordingly. (See step-by-step instructions on Disupting Credit Report Errors here).

What is a Credit Report?

A credit report is not the same thing that you get when you ask for your "credit report" directly from the credit reporting agencies, Equifax, Experian and TransUnion or through AnnualCreditReport.com. That document that you get when you go directly to a consumer reporting agency is a document known in the credit reporting industry as a consumer disclosure. The purpose of a consumer disclosure is to comply with the federal law which requires the credit reporting agencies to disclose the contents of your credit file to you when you ask for it. Nor is a credit report something that currently exists at this very moment. Unless it just so happens that right now you are applying for credit, you don't have a credit report. A credit report is something that is created at the moment it is asked for.

At its most basic level, a credit report is simply a report that is...

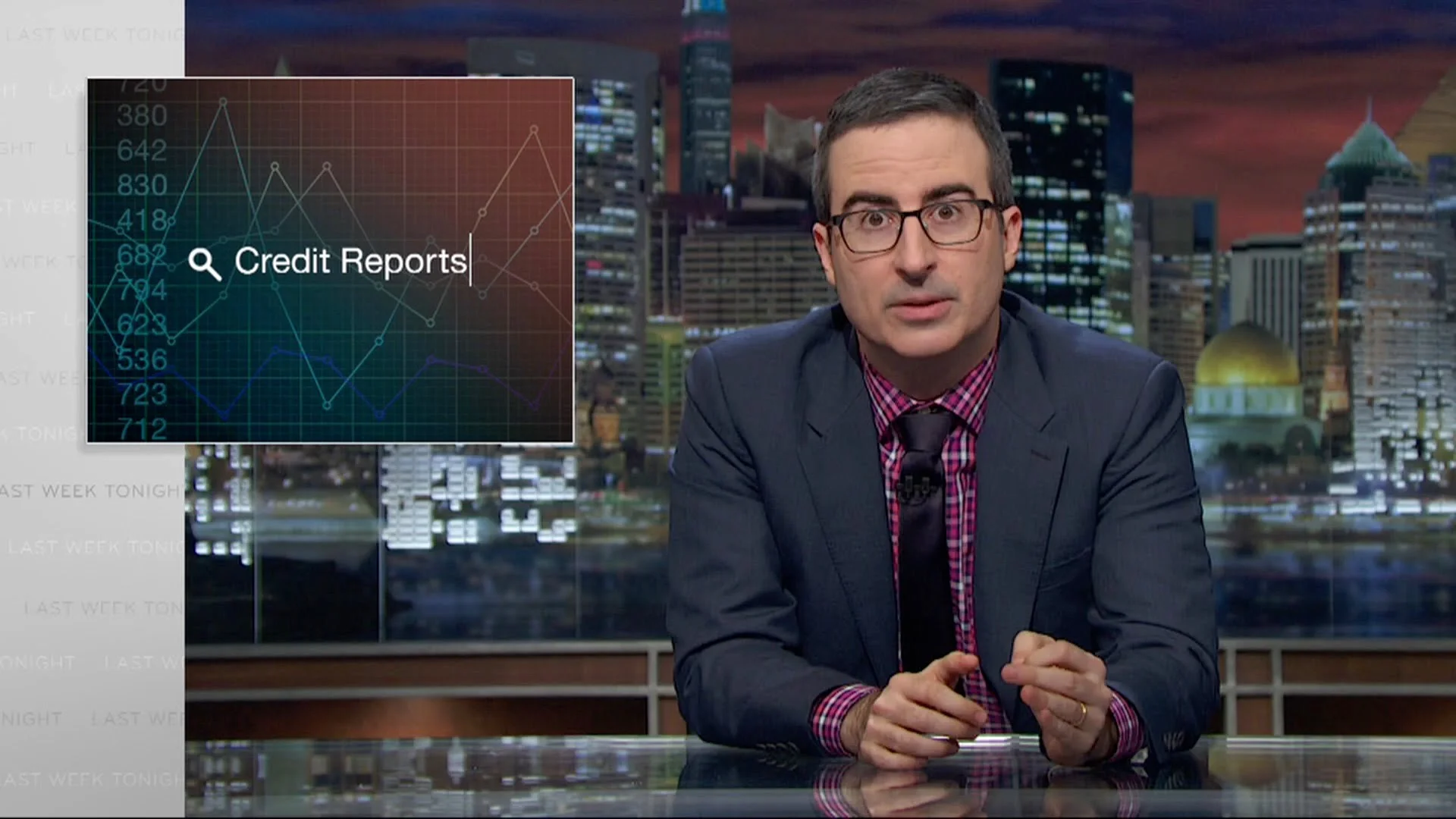

Last Week Tonight with John Oliver: Credit Reports

John Oliver on the Credit Reporting Industry

Earlier this month, HBO's John Oliver of Last Week Tonight did a segment on credit reports. The segment highlights studies which report major problems in the credit reporting industry. The studies reveal that credit reports contain a shocking number of errors. One study found that 25% of consumers had errors in their credit reports. That means that 1 and 4 credit reports have an error. The study further states that 1 and 20 credit reports contain sufficient errors that would make a consumer pay more for a car loan or a mortgage. Credit report errors vary by type and may be serious enough to deny an application for credit, housing or employment.

Defining the Credit File

Inside the database of a credit reporting agency...

To know what a credit file is you must first understand what a database is and how it functions. A database is structured data that is accessible in a variety of ways. There are about a dozen different kinds of databases, and the credit reporting agencies use one of the most common types, a relational database. At the most basic level, a relational database is an electronic database that arranges information into one or more tables with a unique identifier for each row. In a credit reporting agency's database, each row represents a single consumer while each column contains bits of information attributed to the column header (such as Social Security number or date of birth).

Credit Reporting Complaints from the Military Community

Yesterday, the Consumer Financial Protection Bureau (CFPB) released its fourth annual report detailing the complaints received from military servicemembers, veterans and their families. Since the CFPB first started taking complaints in July of 2011, the complaint volume has steadily risen. In 2015, the CFPB received thousands of credit reporting complaints from the military community. The reporting of inaccurate credit information was by far the most complained about followed by complaints about the credit reporting company's investigation process.

Credit Files & Credit Reports

The term "credit file" is often used interchangeably with "credit report", but in the credit reporting industry these terms are distinctly different. A credit file is a bit of raw data contained within a database. At any given time, the national consumer reporting agencies maintain hundreds of millions of consumer credit files in their databases. According to some estimates these files relate to approximately 250 million credit active consumers across the United States. This means that many consumers have more than one credit file in a consumer reporting agency's system.

A "credit report" is something that does not currently exist. A credit report is created at the moment that it is asked for. Your credit report might look different today than it will a month from now, and most certainly will look different than it did three months ago. ...

There has been more data breaches than days in 2016

A data breach occurs when protected information is exposed to an unauthorized source. Since the beginning of 2016, one hundred and thirty-nine (139) data breaches have taken place in the U.S. These data breaches subjected at least 4,294,005 records to identity theft.

No country or entity is immune to data breaches; even ISIS. An article published on March 10 reports that an ISIS data breach disclosed the names, hometowns, blood types, and other personal information about 22,000 members. In the wrong hands, this kind of sensitive information could be deadly.

Is someone else's credit history mixed with yours?

Mixed Credit Reports

The credit reporting agencies collect information about you and store it in their databases. Equifax, Experian, and Trans Union all have their own database. This is why you have three different credit reports. The databases contain hundreds of millions of bits of raw data, referred to as credit files. Most consumers have more than one credit file. Credit files are used to generate credit reports. A mixed credit report is the result of a credit reporting agency’s inaccurate merging of credit information and/or an entire credit file belonging to one consumer into the credit report of another consumer.

When your credit history is requested, the credit reporting agencies sort though the millions of bits of electronic data stored within their databases. Search results defer depending upon the search terms used. For example: the results of a search for Jane Doe may vary from the results for a search for Jane A. Doe. ...

Is your child's identity safe?

Hundreds of millions of identities are exposed to identity theft each year. In a recent study, it was found that: "10.2% of children had someone else using their Social Security number. This is 51 times higher than the 0.2% rate for adults". A child's Social Security number was used more often than an adults for a variety of reasons. A child's Social Security number is very enticing to thieves because it is unused and can be paired with any name and birth date. In addition, a child's identity can be used for years before being detected.

To know if your child has been a victim of identity theft, check to see if your child has a credit report. It is important to check all three of the credit reporting agencies as the reports are not identical.

Who is allowed to pull your credit report?

Not just anyone can pull your credit report. The Fair Credit Reporting Act, the federal law which governs credit reporting, allows credit reporting agencies to generate your credit report under the following circumstance and no other:

- by written request from you or a guardian

- by court order

- by request from a state or local child support enforcement agency

- by request of others who intend to use your credit report:

- to extend credit (including landlords and utilities)

- to collect debt (debt collectors)

- for employment purposes

- for insurance underwriting purposes

- to determine eligibility for a license or government benefits

- to determine if you meet the terms of an account

- for business transactions